Rebates

View current rebates offered by manufacturers. Please contact us with any questions.

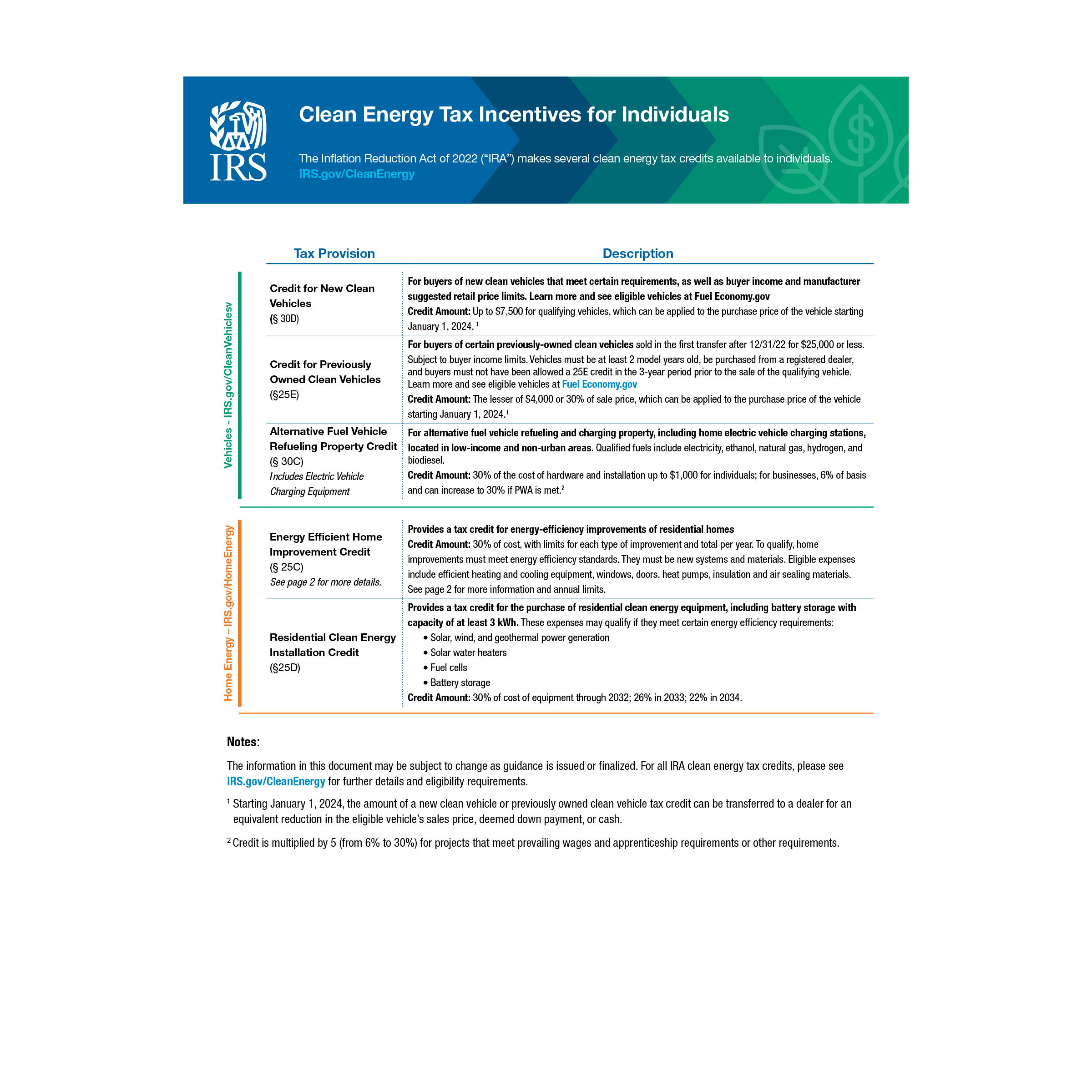

30% US Tax Credit

On the purchase and installation of high efficiency wood stoves.

- Consumers buying highly efficient wood stoves will be able to claim a 30% tax credit that is based on the full cost of the wood stove, including purchase AND installation.

- The tax credit is capped at $2,000 annually with no lifetime limit.

- The 30% tax credit is valid from January 1, 2023 through December 31, 2032.

- Qualifying wood stoves must meet at least a 75% HHV efficiency value.

- You will need your purchase receipt (showing cost of product and installation).

S’more Savings

Save up to $900 on select Hearthstone appliances. Valid from June 15th, 2025 through August 1st, 2025.

Download PDF of S'MORE Savings to view eligible models.

$300 Cash Back

$300 Cash Back with the purchase of any Perlick icemaker unit.

Download PDF of Rebate Form